- Blockletter

- Posts

- Who is The SEC? - Understanding the US Securities and Exchange Commission (SEC)

Who is The SEC? - Understanding the US Securities and Exchange Commission (SEC)

Understanding the SEC: From Regulation to Crypto Approval, Exploring Spot Bitcoin ETFs and More

The Securities and Exchange Commission (SEC) serves as a pivotal regulatory body in the United States, entrusted with safeguarding investors, fostering fair market environments, and facilitating the formation of capital.

Established in 1934 amid the economic turmoil of the Great Depression, the SEC's inception followed the enactment of the Securities Act of 1933, the pioneering federal law governing securities issuance. Its primary mandate is the regulation and enforcement of this pivotal legislation.

With a broad purview, the SEC supervises a spectrum of entities, including broker-dealers, investment companies, and investment advisers, ensuring compliance with regulatory standards. Additionally, it exercises oversight over clearing agencies, transfer agents, credit rating agencies, and securities exchanges.

In its role as a watchdog, the SEC extends its influence over key industry bodies such as the Financial Industry Regulatory Authority (FINRA), the Municipal Securities Rulemaking Board (MSRB), and the Public Company Accounting Oversight Board (PCAOB), reinforcing accountability and transparency.

The agency's authority underwent significant augmentation in 2010 with the passage of the Dodd-Frank Act, broadening its reach to encompass municipal advisors and other entities. This expansion underscores the SEC's evolving role in maintaining the integrity and resilience of the financial landscape.

Inside the SEC

The leadership of the Securities and Exchange Commission comprises a maximum of five commissioners, appointed by the President with Senate confirmation. Notably, no more than three commissioners can belong to the same political party, ensuring a balanced approach to governance.

Furthermore, the agency is structured into several divisions, each dedicated to distinct aspects of its regulatory responsibilities. These divisions encompass enforcement, corporation finance, economic and risk analysis, examinations, trading and markets, and investment management.

Each division serves a crucial function within the agency's framework. For instance, the Division of Corporation Finance is tasked with ensuring that investors receive essential information necessary for making informed investment decisions. Meanwhile, the Division of Enforcement is responsible for probing potential violations of federal securities laws, safeguarding the integrity of the financial markets.

Objectives of the SEC

The SEC operates with three overarching objectives, each vital to its mandate:

1. Investor Protection: Central to its mission, the SEC endeavors to safeguard investors' interests by ensuring they have access to accurate and pertinent information concerning publicly offered securities. Additionally, it strives to shield investors from fraudulent or manipulative practices that could jeopardize their financial well-being.

2. Market Integrity: The SEC is committed to fostering fair, orderly, and efficient markets. It achieves this by meticulously regulating exchanges, securities brokers, dealers, and other participants, thereby upholding the integrity of the marketplace.

3. Capital Formation Facilitation: Playing a pivotal role in the economy, the SEC facilitates the capital-raising endeavors of companies. By overseeing the issuance of new securities and enforcing compliance with regulations, the agency promotes transparency and confidence in the capital-raising process.

The SEC's Involvement in the Crypto Sphere

Cryptocurrency regulation has emerged as a focal point for the Securities and Exchange Commission (SEC), with past and present chairs addressing its complexities.

Former SEC Chair Jay Clayton took a firm stance on initial coin offerings (ICOs) in 2017, expressing concerns over their potential lack of investor protection compared to traditional markets. His tenure saw heightened scrutiny and crackdowns on ICOs to curb potential fraud and manipulation.

In the current landscape, Chair Gary Gensler advocates for increased oversight, emphasizing the need for crypto exchanges to register with the agency. Recent enforcement actions reflect this stance, with the SEC targeting prominent platforms such as Coinbase, Kraken, and Binance for allegedly operating as unregistered entities and engaging in deceptive practices.

The SEC's scrutiny extends beyond exchanges to encompass nonfungible tokens (NFTs). High-profile cases, including charges against Impact Theory and Stoner Cats 2 LLC, highlight the agency's efforts to regulate the burgeoning NFT market and address potential compliance breaches.

While legislative efforts aim to provide clarity on cryptocurrency regulation, no definitive laws have been enacted thus far, leaving the regulatory landscape in flux.

Breakthrough: Spot Bitcoin ETF Approval

In a monumental development for the cryptocurrency sector, the Securities and Exchange Commission (SEC) granted approval for spot bitcoin exchange-traded funds (ETFs) in early 2024, marking a significant milestone. This approval came after a prolonged journey that commenced when Cameron and Tyler Winklevoss first submitted an application for a spot bitcoin ETF to the agency in 2013.

A pivotal moment leading to the SEC's decision occurred in the summer of 2023, when a judicial panel mandated a reassessment of Grayscale Investments' proposal for a spot bitcoin ETF. The court's ruling prompted the SEC to reconsider its approach to both spot bitcoin ETFs and bitcoin futures ETFs.

The court emphasized the similarities between proposed spot bitcoin ETFs and already-approved bitcoin futures ETFs, particularly in terms of underlying assets and surveillance sharing agreements. It emphasized the potential for detecting fraudulent or manipulative activities in the market for bitcoin and bitcoin futures.

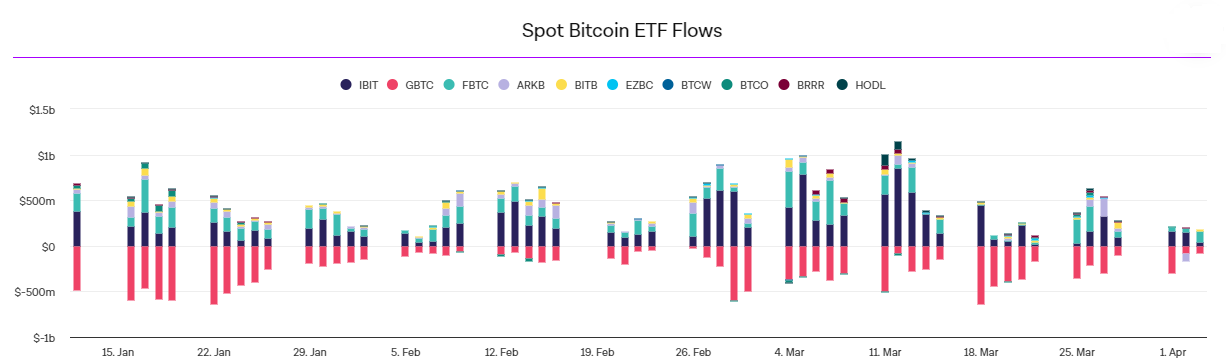

Following this, the SEC greenlit 11 spot bitcoin ETFs, including those from reputable firms such as BlackRock and Fidelity. However, SEC Chair Gensler was quick to clarify that approval did not equate to an endorsement of bitcoin itself. Nonetheless, the approval provided institutional and retail investors with a regulated avenue to gain exposure to bitcoin through conventional investment channels, resulting in substantial inflows into spot bitcoin ETFs.

Despite this groundbreaking development, the SEC has yet to approve any spot Ethereum ETFs, leaving the door open for further regulatory evolution in the cryptocurrency space.